Ce site utilise des cookies afin que nous puissions vous fournir la meilleure expérience utilisateur possible. Les informations sur les cookies sont stockées dans votre navigateur et remplissent des fonctions telles que vous reconnaître lorsque vous revenez sur notre site Web et aider notre équipe à comprendre les sections du site que vous trouvez les plus intéressantes et utiles.

Ophélie Dantil

Tax attorney specialised in the art market

What is the nature of your activity as a tax attorney?

In my capacity as a specialised tax attorney, I support my individual and corporate clients in the management of their tax obligations. French tax law is complex, and I ensure that my clients’ taxes are calculated most precisely and that their taxation level is optimal.

For several years, I have become aware of the existence of a genuine need for tax law support in the art community. This area is still highly confusing for many persons: in this field, you can come across all sorts of contradictory statements. I have sought to bring legal certainty to my clients and to avoid in particular that they might unknowingly commit a fraud, due to a lack of necessary expertise. I have thus decided to add this new string to my bow.

In this “art market law and taxation” practice area, which clients are targeted by your services?

My clients are all those who own or would like to own art – therefore, this includes a very broad public! My services range from advising individuals, who would like, for instance, to sell or transmit a family painting, to designing an asset management strategy for executive officers or large collectors. My tax knowledge enables me to identify solutions suited to each situation. The art market is not governed by specific taxation rules as such, and my work consists in applying general tax law (wealth tax, international taxation, estate tax, etc.) to questions encompassing art properties.

In the life of your clients, at which point do you intervene?

I can provide services prior to filing a tax return or at a later stage, e.g. in case of a tax reassessment, in order to mitigate such reassessment’s cost. I can also advise my clients in preparing their succession. Indeed, there exist several forms of gift or partition inter vivos that make it possible to anticipate and control the cost of a transmission.

Can you give us a few concrete examples?

As a case in point, a client sold for € 1,000,000, through a foreign gallery, a work of art that he had acquired against a price of € 50,000. He wondered about the tax status of this transaction. Everybody was telling him that he would not be subject to any capital gain tax. Wrong! I enabled him to achieve compliance with French tax law.

A further question recently arose when another client who had imported a work of art from the United States consulted me about whether he could include transportation costs in the aggregate acquisition price in order to reduce the amount of his capital gain.

What is your greatest professional satisfaction?

Enabling my clients to do something that they would not have been able to achieve without my advice.

I offer keys to problem-solving, and I orchestrate solutions enabling my clients to fulfil their dreams in the context of meaningful projects. Also, I feel deep satisfaction that, through my work, I am able to participate in the art world.

Finally, what would you recommend to our users who would like to sell a work of art and reduce their tax bill?

The sale of a work of art against a price in excess of € 5,000 is subject to a flat tax equal to 6.5% of the sale price. The seller may elect to be taxed at the rate of 36.2% on the amount of the capital gain, and this may prove interesting. To that end, it is necessary to retain all documents, photographs or inventories proving the work’s acquisition date and authenticity. If it can be proved that the seller has owned the work for more than 22 years, then the sale is not taxable. For more recent acquisitions, it is in your best interest to be able to prove the length of the ownership period, so as to reduce taxation. When my clients are not in possession of any invoice or old inventory document, I recommend that they create a file proving the date of purchase and acquisition price, by having an inventory prepared by an expert.

For more information concerning Ophélie Dantil, click Here

France Estimations is the leading network of auctioneers, art experts and tax attorneys in France. We appraise your objects free of charge, and we can help you sell them, either through an auction or a private sale. Our tax attorney can advise you on the tax consequences of your art sale To contact us free of charge.

To contact Ophélie Dantil

- Envoyer vos photos

- Estimation gratuite en 24 heures.

Estimations récentes gratuites

Estimation coiffeuse années 30 en bon état

25 Avr 2024

Il s’agit d’une coiffeuse datant des années 30, appartenant à la catégorie des meubles anciens. Elle est en bon état général, comme en témoigne …

Estimation miroir ancien style Regence avec fronton en bois argenté – 18e siècle

25 Avr 2024

Description du miroir Régence à estimer.

Cet article …

Estimation Bague Marguerite Années 20 en Or et Diamant – Taille 56

25 Avr 2024

Description de la bague marguerite à estimer

Ici, l’objet en question …

Estimation : Pendule Empire en marbre et bronze, 38x24x11 cm

25 Avr 2024

Cette estimation concerne une pendule Empire en marbre et bronze, mesurant 38 cm de hauteur, 24 cm de largeur et 11 cm de profondeur. Ces dimensions sont assez classiques …

De l’estimation d’un panneau de laque de Tran Phuc Duyen à son prix record

22 Avr 2024

France Estimations a récemment reçu une demande d’estimation pour un paravent de Phuc Duyen Tran. Après expertise et grâce à nos conseils, l’oeuvre a obtenu 290 000 euros …

Estimation et prix obtenu par une bague Tank

16 Avr 2024

Description de la bague objet de la demande

Histoire de la bague Tank

La …

Estimation Paul Aizpiri gratuite

09 Avr 2024

Vous possédez une œuvre de Paul Aizpiri ? Découvrez le prix, la valeur ou la cote de votre peinture, tableau, dessin ou aquarelle ! Nos …

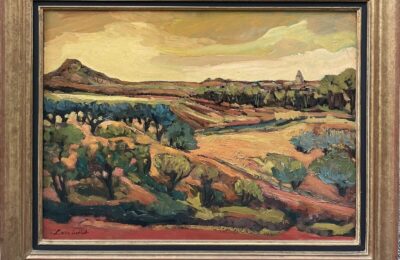

Estimation d’une peinture de paysage provençal de F. Lombardi

26 Mar 2024

L’objet d’art dont nous allons parler dans cet article est une peinture intitulée « Paysage Provençal ». C’est une œuvre réalisée par l’artiste …

Estimation d’un tableau paysage de Venise – Dimensions 30×40

26 Mar 2024

Il s’agit d’un tableau de la catégorie Estimation Peinture, intitulé « Tableau paysage Venise ». La toile est peinte et mesure 30×40 cm.

Contexte …